Something special has arrived at Right Way Credit Union 2025 and it’s made for sunny days, memory making, and a little more freedom.

Picture This…

A quiet beach. The warm breeze. Sand under your feet.

Or maybe… marshmallows over a campfire, the kids laughing under the stars, and no mobile phones or tablets in sight…

Whatever summer means to you, we’re here to help!

We’ve launched a special Summer Loan to help you make it happen.

What’s the Summer Loan?

It’s a limited-time loan designed to support your summer plans, whether that’s a family break, a home project, or just managing the seasonal squeeze.

Borrow between £1,000 and £2,500

Repay over 12 months

Fixed rate of 19.6% APR

Example (Based on Approx Figures): Borrow £1,000

Monthly repayments of £93.00

Total repayable: £1,097.00

✔ No early repayment fees

✔ No top-ups allowed

✔ Repay in full before applying again

Who Can Apply?

£1,000 over 12 months = £93 per month.

(Approx Total Interest £98)

You can apply for a Personal Loan in 2 ways:

Online

Follow this link – Activate Account and apply online via our Mobile App.

Download our app from the links below:

Along with your loan application we require your proof of income. This includes 2 months bank statements which you can provide through open banking by clicking here

Alternatively, you can send copies of your bank statement and other proof of income via email info@rwcu.co.uk

*Please note that we will be unable to process your loan without proof of income. Please email your proof of income to info@rwcu.co.uk

In Person

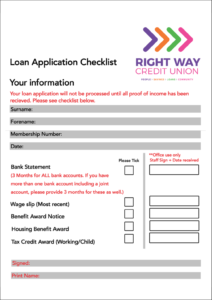

If you wish to apply for this loan in our office you will have to complete a loan application form, please see Loan Application Checklist below for what you will need to bring with you.

Failure to bring the correct documentation for the loan will result in a delay.

We can only accept loan applications that have the correct proof of income.

Terms & Conditions Apply

You must be 18 or over to apply for a loan.

Click Here – RWCU Loan T&C (V1 02.06.25) to download full Terms & Conditions

You must NOT be using debt Management Company or are in the process of being declared bankrupt or entering into a Trust Deed or a Debt Arrangement Scheme as we will not be able to process the loan.

Loan applications may be subject to a credit search.

For members who rely solely on benefits for an income loans are capped at £3,000.

When you have a loan running your savings are held as security against your loan, this means that no share withdrawals can be processed whilst your loan balance is higher than your savings balance, for more information please send us an email to info@rwcu.co.uk

After applying we will require you to supply proof of your income; please see checklist above for what proof of income will need to be provided.

You can also use the secure message service on your online account to contact us.

For more information and further terms and conditions, please contact the office on 0141 889 7442 or you can send us an email to info@rwcu.co.uk

If you have received arrears letters on your current loan this may affect any future borrowing. It is your responsibility to ensure your loan is paid up to date. If you are in financial difficulty please contact us on 0141 889 7442.